Mortgage Calculator

10-year interest-only mortgage calculator—a free, easy-to-use tool that helps you plan smarter and boost your financial productivity. All our tools are 100% free and designed for quick, accurate results

The Tools You Use To Improve Productivity

10-year interest-only mortgage calculator—a free, easy-to-use tool that helps you plan smarter and boost your financial productivity. All our tools are 100% free and designed for quick, accurate results.

Step-by-Step: How the 10-Year Interest-Only Mortgage Calculator Helps You

- Meet Your New Favorite Tool

Imagine you want to buy a house one day—but you don’t want to pay too much right away. That’s where the 10-year interest-only mortgage calculator comes in! This smart tool shows you how much you’ll pay each month if you only pay the interest for 10 years. It’s simple, fast, and best of all—it’s free!

2. Why Use a Calculator Like This?

Grown-ups use money tools to make smart choices. The 10-year interest-only mortgage calculator helps them see how much they owe without getting confused. Instead of guessing, they type in a few numbers and get clear answers. You can think of it like a math helper for big life decisions!

3. How It Works—Made Super Simple

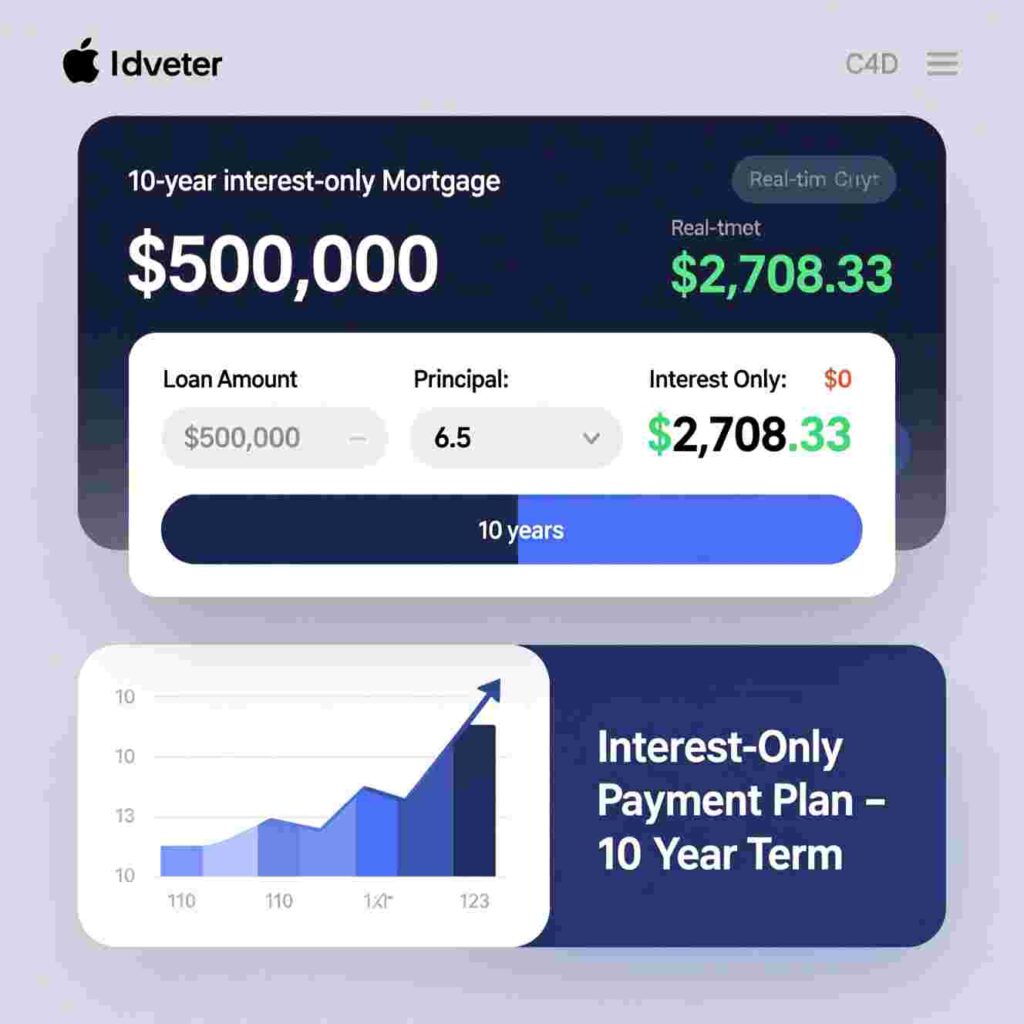

Here’s how you use the 10-year interest-only mortgage calculator:

First, type in the price of the house (or how much you borrow).

Next, add the interest rate your bank gives you.

Then, click “Calculate!”

Boom! The tool shows your monthly payment for 10 years. After that, you’ll start paying back the actual loan. But for now, you only pay the “extra” part—the interest.

4. Free and Easy for Everyone

You don’t need to sign up or pay money. The 10-year interest-only mortgage calculator lives online, ready whenever you need it. Just open your browser, find the tool, and go! No confusing buttons. No secret fees. Just clear, helpful info.

5. Boost Your Productivity

“Productivity” means getting things done faster and smarter. When you use tools like the 10-year interest-only mortgage calculator, you save time and avoid mistakes. That’s why smart people love free online tools—they help you focus on what really matters.

6. Try It Yourself!

Even if you’re only learning about money, you can play with the 10-year interest-only mortgage calculator. Change the numbers and watch what happens! What if the house costs more? What if the interest rate goes up? You’ll learn how money works—without spending a cent.

Why are All Our Tools Special

We build every tool to be 100% free and easy to use. No tricks. No pop-ups. Just clean, friendly tools that help you learn and plan. Whether you’re a student, a parent, or someone saving for a dream house, our tools grow with you.

The 10-year interest-only mortgage calculator is just one example. We also have budget trackers, savings helpers, and more—all made with simple words and big ideas. Because everyone deserves to understand money, no matter their age.

So next time you hear “mortgage” or “interest,” don’t panic! Just remember: there’s a free tool waiting to help you figure it out—one step at a time.

Ready to try it? Visit our site, find the 10-year interest-only mortgage calculator, and start exploring today. Your future self will thank you!

Discover our 10-year interest-only mortgage calculator—a free, easy-to-use tool that helps you plan smarter and boost your financial productivity. All our tools are 100% free and designed for quick, accurate results. free

10-year interest-only mortgage calculator—100% free, easy to use, and built to boost your financial productivity. Try it today!

The Tools You Use to Improve Productivity

Have you ever tried to finish your homework, only to realize you’ve spent 20 minutes looking for your pencil? Or started building a LEGO set with no idea where the instructions went? Tools matter. The right tool at the right time can turn a frustrating mess into a smooth, fun, and fast success.

This article helps people get more done in less time. You’ll learn what a mortgage is (don’t worry—it’s simpler than it sounds!), why a 10-year interest-only mortgage calculator is super helpful, and how free, easy-to-use tools boost productivity for everyone, even grown-ups managing money.

Best of all: everything we talk about is 100% free and made for real people—not just math experts!

What Is Productivity, Anyway?

Productivity only means doing useful things without wasting time, energy, or money. Imagine you’re baking cookies:

Unproductive way: You forget the sugar, run to the store, forget the eggs, run back… and your cookies burn.

Productive way: You check your list, gather everything first, and bake perfect cookies in one go.

Tools help you skip the mess and go straight to the good part. A mixer saves arm strength. A timer stops your cookies from burning. And in money matters? A 10-year interest-only mortgage calculator saves confusion—and cash.

What’s a Mortgage? (Think: Giant Piggy Bank Loan)

Let’s pretend you want to buy a treehouse. But this treehouse costs $100,000! You can’t pay that all at once, so you ask your neighbor (a bank) to lend you the money.

In real life, people do this to buy houses—and that loan is called a mortgage.

Every month, you pay the bank back a little bit. Over time, you own the house completely. But mortgages come in different flavors—like chocolate, strawberry, or vanilla ice cream an interest-only mortgage.

What’s an Interest-Only Mortgage?

Normally, your monthly mortgage payment has two parts:

Principal – The actual money you borrowed.

Interest – The “thank you” fee the bank charges for lending you money.

But in an interest-only mortgage, you only pay the interest for a certain time (like 10 years!). That means your monthly payment is smaller during those years. After that, you start paying back the real loan—or you might pay it all at once.

Why would someone do this?

Maybe they expect more money later (like a big amount).

Maybe they want to use their cash for something else right now (like fixing the roof or sending kids to school).

Maybe they only want lower payments for a while.

But here’s the catch: you still owe the full amount later. So it’s important to plan carefully.

And that’s where our hero comes in: the 10-year interest-only mortgage calculator.

Meet Your New Best Friend: The 10-Year Interest-Only Mortgage Calculator

Imagine you’re playing a video game, and you need to know how much power your character has left. You don’t guess—you check the meter! A 10-year interest-only mortgage calculator is like that meter for your money.

You type in:

How much you borrowed (say, $200,000)

The interest rate (like 5% per year)

And that it’s a 10-year interest-only deal

Then—poof!—the calculator tells you:

Your monthly payment for the next 10 years (only interest!)

How much total interest will you pay

What happens after year 10

No confusing math. No scary spreadsheets. Just clear, simple answers.

And guess what? All our services are 100% free and easy to use—just like a good game should be.

Why Use This Calculator? 5 Big Reasons

- It Keeps You From Guessing Wrong

Guessing your payments is like guessing how many jellybeans are in a jar. You’ll probably be off—and that mistake could cost hundreds or thousands of dollars.

The 10-year interest-only mortgage calculator gives you the exact number. No more “I think it’s about…”—just “It’s $833.33.”

- It Helps You Compare Choices

What if you also looked at a normal (30-year) mortgage? Or a 15-year one? The calculator lets you try different options and see which fits your budget.

It’s like trying on different shoes to find the most comfortable pair—before you buy.

- It Saves Time

Doing this math by hand takes forever. You’d need to multiply, divide, remember formulas… and you might still get it wrong.

The 10-year interest-only mortgage calculator does it in seconds. That’s time you can spend playing, reading, or helping your family.

- It’s Totally Free

Some websites charge money or make you sign up to use a simple tool. Not here! All our services are 100% free and easy to use—no tricks, no hidden fees. - It Builds Money Confidence

When you understand your payments, you feel calmer. You’re not scared of surprise bills. You can plan vacations, save for college, or even buy that cool bike you’ve been eyeing.

Knowledge = power. And the 10-year interest-only mortgage calculator gives you that power for free.

Real-Life Example: Maya’s Story

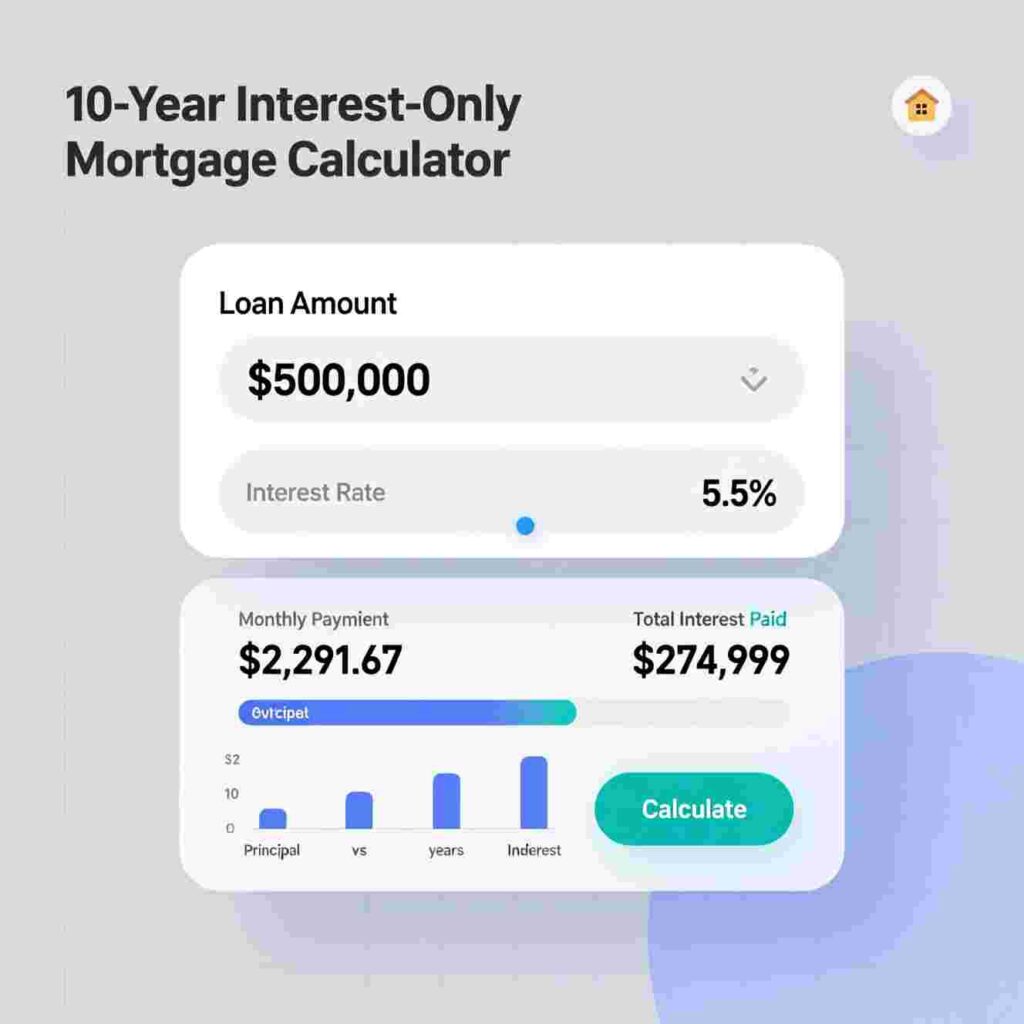

Maya is 35. She’s a teacher. She wants to buy a small house near the school where she works. The house costs $250,000. She has $50,000 saved, so she needs to borrow $200,000.

Maya hears about interest-only mortgages. Her friend says, “Your payments will be lower for 10 years! Perfect while your kids are little.”

But Maya isn’t sure. So she uses a 10-year interest-only mortgage calculator.

She types in:

Loan amount: $200,000

Interest rate: 4.5%

Term: 10 years (interest-only)

The calculator shows:

Monthly payment: $750 (for 10 years)

Total interest paid in 10 years: $90,000

After year 10: She must repay the $200,000—either all at once or by switching to a regular mortgage.

Maya realizes: “$750 a month is doable now… but I need a plan for year 11.”

She talks to a financial advisor. She decides to save $1,000 every month during those 10 years. That way, she’ll have $120,000 saved—plus her original $50,000—to help pay off the loan.

Without the 10-year interest-only mortgage calculator, Maya might have said “yes” without thinking ahead. With it, she makes a smart, safe choice.

How to Use the Calculator (Step by Step)

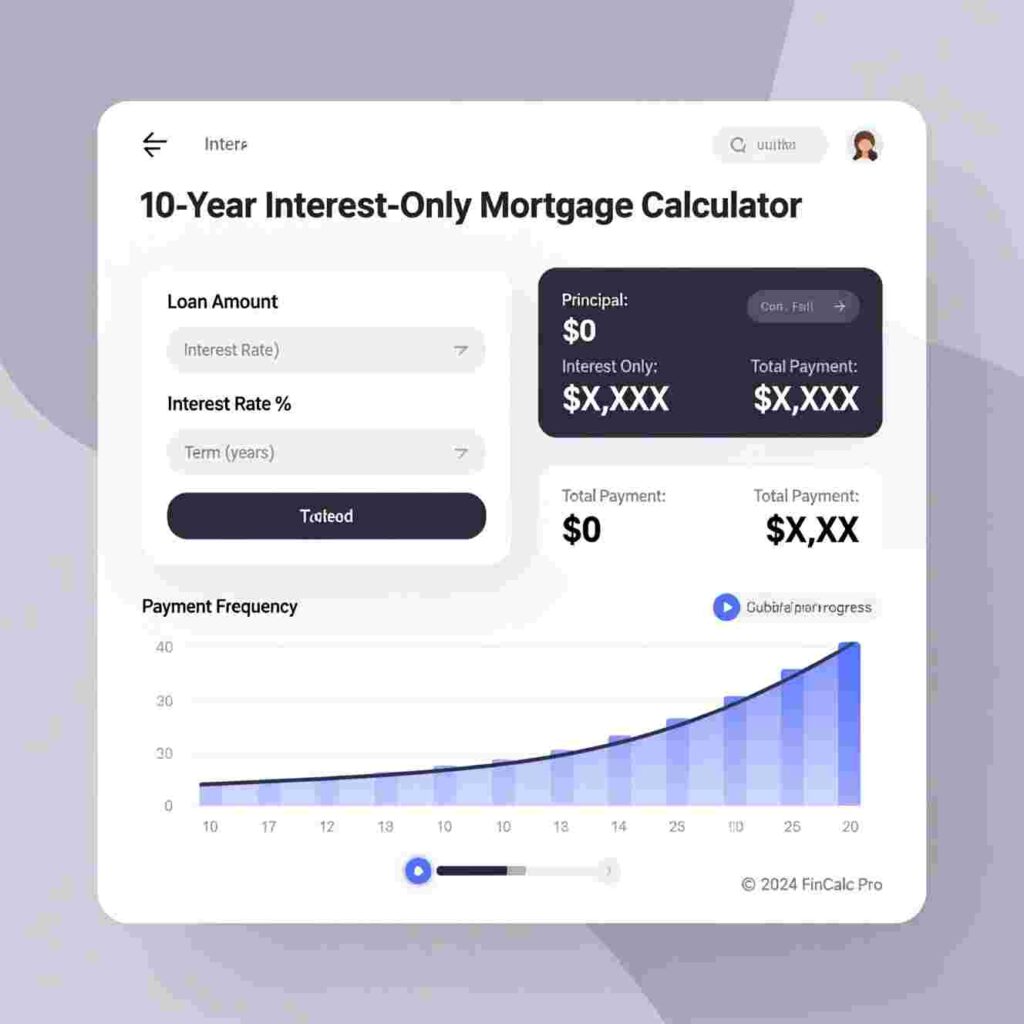

Using our 10-year interest-only mortgage calculator is as easy as making a sandwich:

Step 1: Go to the website

Visit our free tools page. No sign-up. No email needed.

Step 2: Type your loan amount

This is how much money you’re borrowing—like $150,000 or $300,000.

Step 3: Enter the interest rate

This is the yearly percentage the bank charges. If you don’t know it, ask your lender or use an average (like 5%).

Step 4: Select “10-year interest-only”

Make sure the tool knows you want only interest payments for 10 years.

Step 5: Click “Calculate”

Boom! Instant results.

You’ll see:

Your monthly interest payment

Total interest over 10 years

What’s due after year 10

You can even print it or email it to yourself. Easy, right?

Who Should Use a 10-Year Interest-Only Mortgage?

Not everyone needs this kind of mortgage. It’s great for:

People with changing income (like freelancers or business owners)

Those expecting a big payout later (like selling a company or getting an inheritance)

Homebuyers who plan to move in 5–10 years

Families want lower payments now while kids are young

But it’s not great for:

People who hate surprises

Those who can’t save money for the big payment later

Anyone who might forget that the full loan is still due

That’s why the 10-year interest-only mortgage calculator is so important—it shows you the full picture, not just the “low payment” part.

Common Myths About Interest-Only Mortgages

Let’s bust some myths!

Myth 1: “I’ll own my home after 10 years.”

Nope! You only pay interest. You still owe the full loan. You don’t build equity like a regular mortgage.

Myth 2: “It’s always cheaper.”

Not true. You might pay more interest overall if you don’t pay off the loan early.

Myth 3: “It’s too complicated for me.”

Not with our 10-year interest-only mortgage calculator! It explains everything in plain language.

Myth 4: “Only rich people use these.”

Anyone can explore this option—especially if they use free tools to understand it first.

Myth 5: “The bank decides everything.”

You decide! With the right info, you can say “yes” or “no” with confidence.

Productivity Isn’t Just for Work—It’s for Life

You might think “productivity” only matters in offices. But it’s everywhere!

Packing your backpack the night before = productive!

Using a recipe checklist = productive!

Setting a timer to clean your room in 10 minutes = super productive!

And when grown-ups use tools like the 10-year interest-only mortgage calculator, they’re being productive too. They save time, avoid stress, and make better choices for their families.

All our services are 100% free and easy to use—because everyone deserves smart tools, no matter their age or job.

5 More Free Tools That Boost Productivity

While you’re here, check out these other helpful (and free!) tools:

Budget Planner – Track your allowance or family spending

Savings Goal Calculator – See how long to save for a bike or trip

Debt Payoff Tracker – Watch your loans shrink week by week

Time Management Timer – Focus for 25 minutes, then take a break!

Reading Tracker – Log books and earn virtual badges

These tools, like our 10-year interest-only mortgage calculator, turn hard problems into fun, manageable steps.

The Science Behind Simple Tools

Scientists have studied how the brain handles decisions. Too many choices = stress. Too much math = confusion.

But when you use a clear, visual tool (like a calculator with big buttons and simple results), your brain relaxes. You focus better. You make smarter choices.

That’s why we design every tool to be:

Simple (no jargon)

Fast (results in seconds)

Free (no paywalls)

Friendly (like a helpful robot friend!)

Research shows that people who use planning tools are more confident, less anxious, and more successful with money. And it all starts with one click on a 10-year interest-only mortgage calculator.

Tips for Young Readers: Start Building Smart Habits Now!

Even if you’re 10, you can learn about money and productivity:

✅ Use tools – Ask your parents to show you free calculators

✅ Save first – Put 10% of your allowance in a jar before spending

✅ Plan ahead – Make a list before shopping or doing homework

✅ Ask questions – “What’s a mortgage?” is a great question!

✅ Try free stuff – Many websites (like ours!) offer fun, educational tools

You’re never too young to be smart with time and money.

Why “10-Year” Matters

Why not 5 years? Or 15? The “10-year” part is special.

Short enough to keep payments low during busy life stages (like raising kids)

Long enough to plan and save for the big payment later

Common – Many banks offer this exact term, so the 10-year interest-only mortgage calculator matches real-world options

It’s the sweet spot between flexibility and responsibility.

Final Thought: Tools Empower Everyone

You don’t need to be a math genius. You don’t need fancy software. You don’t even need to pay money.

All you need is the right tool—like the 10-year interest-only mortgage calculator—to take control of your future.

And remember: All our services are 100% free and easy to use because productivity shouldn’t be hard. It should feel like winning a game you actually understand.

So go ahead—try the calculator today. See your numbers. Make a plan. And get one step closer to your goals.

Your future self will thank you.